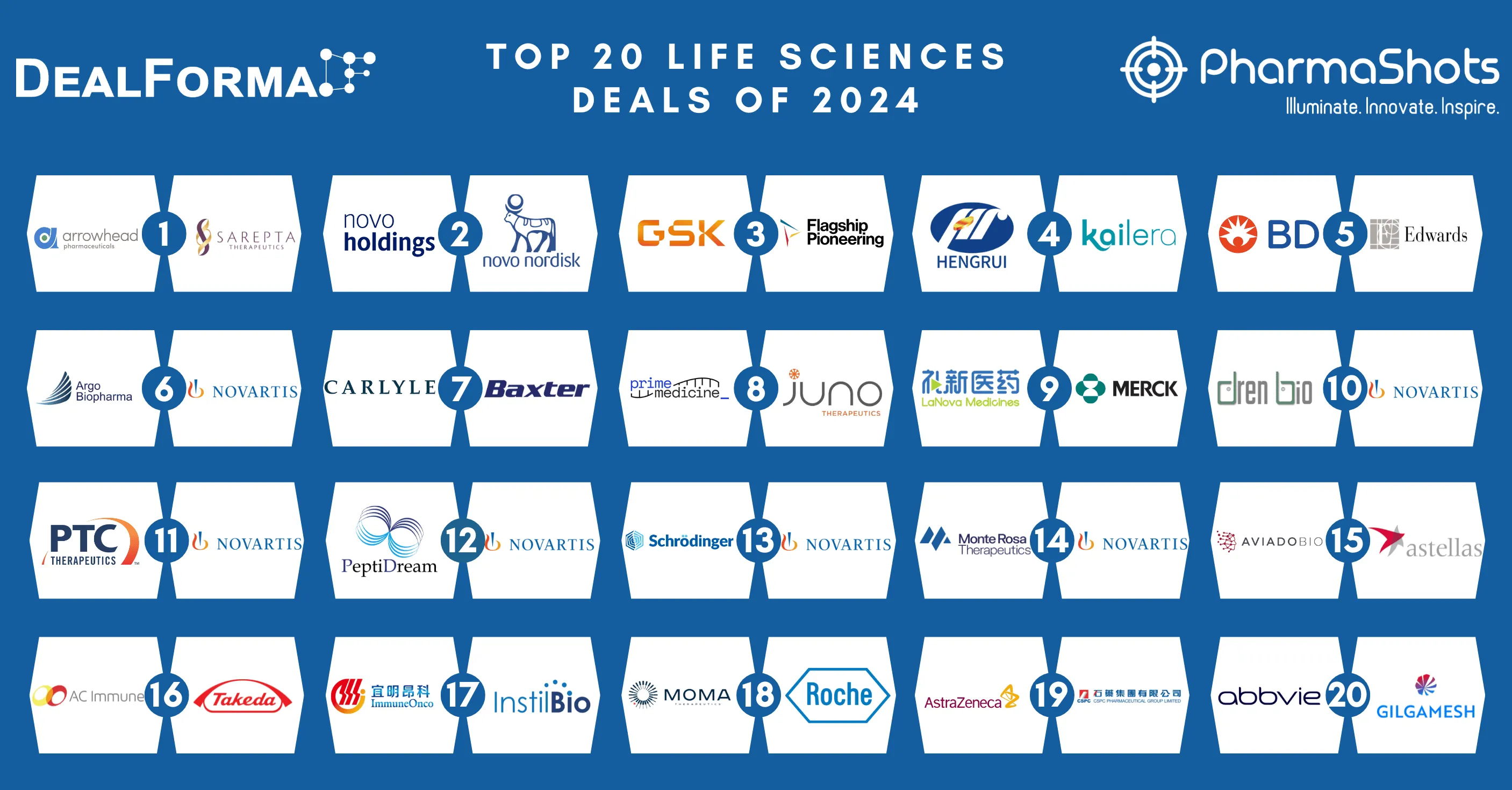

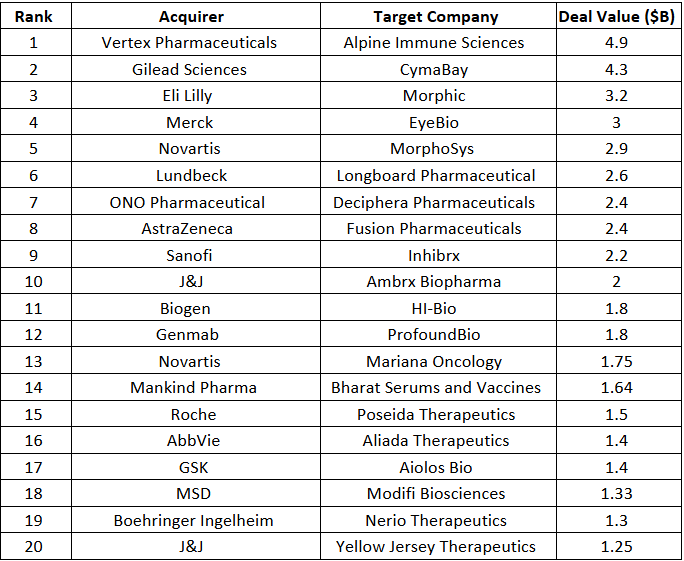

Top 20 Biopharma M&A of 2024 by Total Deal Value

Shots:

- Dealmaking in 2024 experienced fluctuations due to regulatory challenges and increasing pressure from the Inflation Reduction Act

- The highest-value deal of the year was Vertex’s acquisition of Alpine Immune Sciences for $4.9B, followed by Gilead’s acquisition of CymaBay for $4.3B and Lilly’s acquisition of Morphic for $3.2B

- Leveraging Dealforma’s insights, PharmaShots presents an in-depth analysis of the top 20 biopharma M&As of 2024

Note: Columns 1 and 2 represent the rank and acquirer, while Columns 3 and 4 represent the target company and the total deal value

20. J&J and Yellow Jersey Therapeutics

Deal Date: May 28, 2024

Deal Completion Date: Jul 11, 2024

Deal Status: Completed

Deal Value: $1.25B

- Johnson & Johnson has acquired Yellow Jersey Therapeutics, a subsidiary of Numab, to bolster its pipeline in atopic dermatitis

- As part of the acquisition, J&J has secured worldwide rights to NM26, the lead product, for approximately $1.25B in cash.

- NM26, a bispecific antibody, is currently in development for atopic dermatitis and has the potential to treat other inflammatory skin diseases driven by Th2 inflammation and itch

19. Boehringer Ingelheim and Nerio Therapeutics

Deal Date: Jul 29, 2024

Deal Completion Date: Jul 29, 2024

Deal Status: Completed

Deal Value: $1.3B

- Boehringer Ingelheim has acquired Nerio Therapeutics to enhance its immuno-oncology portfolio

- Under the agreement, Nerio Therapeutics will receive up to $1.3B

- The acquisition adds Nerio Therapeutics’ preclinical program to Boehringer Ingelheim's pipeline, with plans to further develop it for cancer treatment

18. MSD and Modifi Biosciences

Deal Date: Oct 23, 2024

Deal Completion Date: Oct 23, 2024

Deal Status: Completed

Deal Value: $1.33B

- MSD has acquired Modifi Biosciences, a company developing direct DNA modification-enabled cancer therapeutics

- Under the terms of the agreement, Modifi Biosciences' shareholders received $30M upfront and are eligible for up to $1.3B in milestone payments

- The acquisition adds a novel class of small molecules targeting a DNA repair protein called MGMT (O6-methylguanine-DNA methyltransferase)

Deal Date: Jan 9, 2024

Deal Completion Date: Feb 15, 2024

Deal Status: Completed

Deal Value: $1.4B

- GSK acquired Aiolos Bio to strengthen its respiratory pipeline, gaining access to Aiolos’ lead drug candidate, including AIO-001

- Under the agreement, Aiolos received an upfront payment of $1B, along with $400M in success-based regulatory milestone payments. Additionally, GSK will pay Jiangsu Hengrui Pharmaceuticals certain success-based milestone payments and tiered royalties

- The acquisition adds AIO-001, which is being developed for asthma, to GSK’s portfolio. Furthermore, Aiolos holds an exclusive license for AIO-001 outside Greater China, granted by Jiangsu Hengrui

16. AbbVie and Aliada Therapeutics

Deal Date: Oct 28, 2024

Deal Completion Date: Dec 11, 2024

Deal Status: Completed

Deal Value: $1.4B

- AbbVie Acquires Aliada Therapeutics, strengthening its focus on Alzheimer's disease and neuroscience portfolio

- Under the agreement, AbbVie acquired all outstanding shares of Aliada Therapeutics for $1.4B in cash

- The acquisition adds Aliada’s lead asset, ALIA-1758, which is being developed for Alzheimer’s disease, to AbbVie’s portfolio. Additionally, it includes Aliada’s Modular Delivery (MODEL) platform, a cutting-edge technology that enables precision CNS drug delivery by leveraging blood-brain barrier (BBB)-crossing mechanisms targeting TfR and CD98 receptors in brain endothelial cells

15. Roche and Poseida Therapeutics

Deal Date: Nov 26, 2024

Deal Completion Date: N/A

Deal Status: Active

Deal Value: $1.5B

- Roche will acquire Poseida for $9/share in cash, strengthening its CAR-T therapy portfolio, with the deal expected to close in Q1’25

- Roche will also pay up to $4/share in non-tradeable CVR milestones, including $2 for a pivotal trial of P-BCMA-ALLO1 by Dec 2028, $1/share for a pivotal trial of P-CD19CD20-ALLO1 or P-BCMACD19-ALLO1 in an autoimmune indication by Dec 2034, and $1/share for P-BCMA-ALLO1’s first sale by Dec 2031, bringing the total deal value to approximately $1.5B

- The acquisition expands Roche’s pipeline with Poseida’s P-BCMA-ALLO1 (P-I, multiple myeloma), P-CD19CD20-ALLO1 (P-I, B-cell malignancies, with FDA INDs for multiple sclerosis & SLE), and another allogeneic dual CAR-T therapy for hematologic malignancies. It also adds P-MUC1C-ALLO1 (P-I, solid tumors), GMP manufacturing capabilities, and genomic preclinical medicines & related technology

14. Mankind Pharma and Bharat Serums and Vaccines

Deal Date: Jul 25, 2024

Deal Completion Date: Oct 23, 2024

Deal Status: Completed

Deal Value: $1.64B

- Mankind Pharma acquired Bharat Serums and Vaccines (BSV), adding BSV’s approved women’s health assets, Assisted Reproductive Therapy (ART) assets, and critical care products to its portfolio

- As part of the agreement, Mankind Pharma acquired 100% of BSV’s shares for $1.64B (INR 13,630 Cr.)

- The acquisition also strengthens Mankind’s portfolio by providing access to BSV’s high-entry barrier products in critical care, backed by advanced complex R&D technology platforms

13. Novartis and Mariana Oncology

Deal Date: May 02, 2024

Deal Completion Date: N/A

Deal Status: Active

Deal Value: $1.75B

- Novartis acquired Mariana Oncology to strengthen its radioligand therapy (RLT) pipeline and expand its research infrastructure and clinical supply capabilities

- Under the agreement, Mariana will receive $1B upfront and an additional $750M upon achieving pre-specified milestones

- The acquisition adds a diverse RLT portfolio, including MC-339 (an Actinium-225-based RLT in development for small cell lung cancer), to Novartis' pipeline

Deal Date: Apr 03, 2024

Deal Completion Date: May 21, 2024

Deal Status: Completed

Deal Value: $1.8B

- Genmab acquired ProfoundBio for an aggregate of $1.8B in cash. ProfoundBio is a clinical-stage biotech company focused on antibody-based therapeutics in oncology

- The acquisition strengthens Genmab’s oncology portfolio and provides access to ProfoundBio’s novel ADC platform technologies

- The deal includes global rights to three clinical candidates, including rinatabart sesutecan (Rina-S)

Deal Date: May 22, 2024

Deal Completion Date: Jul 02, 2024

Status: Completed

Deal Value: $1.8B

- Biogen acquired Human Immunology Biosciences (HI-Bio), a privately held clinical-stage biotech company focused on developing targeted therapies for severe immune-mediated diseases

- HI-Bio received $1.15B upfront and is eligible for up to $650M in potential development milestones

- The acquisition adds felzartamab, an investigational anti-CD38 monoclonal antibody, to Biogen’s portfolio

10. Johnson & Johnson and Ambrx Biopharma

Deal Date: Jan 08, 2024

Deal Completion Date: Mar 07, 2024

Status: Completed

Deal Value: $2B

- Johnson & Johnson (J&J) acquired Ambrx Biopharma, a biopharmaceutical company focused on developing antibody-drug conjugates (ADCs) for cancer treatment

- J&J acquired all outstanding shares of Ambrx’s common stock for $28.00 per share in cash

- The acquisition strengthens J&J’s oncology portfolio with preclinical and clinical ADC programs, including ARX517 (metastatic castration-resistant prostate cancer), ARX788 (HER2+ breast cancer), and ARX305 (renal cell carcinoma)

Deal Date: Jan 23, 2024

Deal Completion Date: May 30, 2024

Status: Completed

Deal Value: $2.2B

- Sanofi acquired Inhibrx after the spin-off of non-INBRX-101 assets into Inhibrx Biosciences

- Sanofi acquired all outstanding shares of Inhibrx for $30.00 per share in cash, totaling $1.7B in equity value. Sanofi also paid Inhibrx’s outstanding third-party debt and retained an 8% equity stake in New Inhibrx through a $200M investment

- Inhibrx’s Shareholders received a non-transferable contingent value right (CVR) worth up to $800M upon achieving regulatory milestones and 0.25 shares in New Inhibrx per Inhibrx share

8. AstraZeneca and Fusion Pharmaceuticals

Deal Date: Mar 18, 2024

Deal Completion Date: Jun 04, 2024

Status: Completed

Deal Value: $2.4B

- AstraZeneca acquired Fusion Pharmaceuticals, a biopharmaceutical company focused on developing radioconjugates

- Under the terms of the agreement, AstraZeneca acquired all outstanding shares of Fusion for $21 per unit in cash, totaling approximately $2B. Additionally, a non-transferable contingent value right (CVR) of $3 per unit in cash will be paid upon reaching a specific regulatory milestone, bringing the total deal value to approximately $2.4B. AstraZeneca also acquired Fusion’s cash, cash equivalents, and short-term investments, which totaled $211 million as of March 31, 2024

- The acquisition enhances AstraZeneca’s pipeline with Fusion’s radioconjugate (RC) candidates, including FPI-2265, currently in a P-II study for metastatic castration-resistant prostate cancer (mCRPC). It also strengthens AstraZeneca’s R&D capabilities and expands its manufacturing and supply chain expertise in actinium-based radioconjugates while bolstering its presence in Canada

7. ONO Pharmaceutical and Deciphera Pharmaceuticals

Deal Date: Apr 29, 2024

Deal Completion Date: Jun 11, 2024

Status: Completed

Deal Value: $2.4B

- ONO Pharmaceutical acquired Deciphera Pharmaceuticals to strengthen its oncology portfolio and expand its presence across the U.S. and EU, reinforcing its kinase drug discovery research

- Under the agreement, ONO acquired all outstanding shares of Deciphera for $25.60 per share in cash. Following the acquisition, Deciphera was merged with ONO’s subsidiary, bringing the total transaction value to $2.4B in equity

- The acquisition adds Qinlock, a switch-control inhibitor for the treatment of fourth-line gastrointestinal stromal tumors (approved in the U.S. and 40 other regions), as well as investigational candidates vimseltinib and DCC-3116 (a ULK inhibitor) to ONO’s portfolio

6. Lundbeck and Longboard Pharmaceuticals

Deal Date: Oct 14, 2024

Deal Completion Date: Dec 02, 2024

Status: Completed

Deal Value: $2.6B

- Lundbeck acquired Longboard Pharmaceuticals, a clinical-stage biopharma company, under a strategic agreement aimed at strengthening its neuro-rare disease portfolio

- As per the agreement, Lundbeck acquired all outstanding shares of Longboard for $60 per share in cash, valuing the deal at $2.6B in equity. Of this, $2.5B is net of cash (~DKK 17B)

- The acquisition adds bexicaserin, a 5-HT2C agonist being developed for the treatment of seizures associated with Dravet syndrome, Lennox-Gastaut syndrome, and other rare epilepsies, to Lundbeck’s portfolio

Deal Date: Feb 05, 2024

Deal Completion Date: Apr 11, 2024

Status: Completed

Deal Value: $2.9B

- Novartis acquired MorphoSys, a Germany-based global biopharmaceutical company focused on oncology drug development

- Novartis acquired all MorphoSys’ shares at $73 per share, totalling $2.9B in cash. The acquisition was accepted by ~79.6% of MorphoSys’ total share capital, including ~11.6% of shares acquired by Novartis BidCo AG outside the official offer

- This deal added Pelabresib (P-II) a second-line treatment for essential thrombocythemia and Tulmimetostat, an investigational drug targeting EZH1 and EZH2 proteins, currently in trials for solid tumors and lymphomas

Deal Date: Jul 08, 2024

Deal Completion Date: Jul 12, 2024

Status: Completed

Deal Value: $3B

- Merck acquired EyeBio, a private clinical-stage ophthalmology biotechnology company developing treatments for vision loss associated with retinal vascular leakage.

- Merck acquired all outstanding shares of EyeBio for $3B, structured as $1.3B upfront in cash and up to $1.7B in developmental, regulatory, and commercial milestone payments

- The acquisition added Restoret (EYE103) a lead candidate for treating retinal diseases and other clinical and preclinical assets targeting retinal disorders. EyeBio will continue developing Restoret under Merck’s expertise

Deal Date: May 29, 2024

Deal Completion Date: Aug 16, 2024

Status: Completed

Deal Value: $3.2B

- Eli Lilly acquired Morphic Holding, strengthening its immunology portfolio with oral integrin therapies

- Lilly purchased all outstanding shares of Morphic at $57 per share, totalling $3.2B

- The acquisition added MORF-057 (α4β7 integrin inhibitor) in P-II trials for ulcerative colitis and Crohn’s disease and multiple preclinical candidates targeting autoimmune diseases, pulmonary hypertension, fibrotic diseases, and cancer

Deal Date: Apr 10, 2024

Deal Completion Date: Mar 24, 2024

Status: Completed

Deal Value: $4.3B

- Gilead Sciences acquired CymaBay, a clinical-stage biopharmaceutical company developing treatments for liver diseases and other chronic conditions

- Gilead purchased all CymaBay shares at $32.50 per share, totaling $4.3B

- The acquisition expanded Gilead’s liver disease portfolio, adding Seladelpar, a potential treatment for primary biliary cholangitis (PBC) and pruritus

1. Vertex Pharmaceuticals and Alpine Immune Sciences

Deal Date: Apr 10, 2024

Deal Completion Date: May 20, 2024

Status: Completed

Deal Value: $4.9B

- Vertex Pharmaceuticals acquired Alpine Immune Sciences, a biotechnology company specializing in the discovery and development of innovative protein-based immunotherapies.

- Under the terms of the agreement, Alpine’s shareholders received $65 per share in cash, bringing the total deal value to $4.9B

- This acquisition added two Phase II assets to Vertex’s pipeline Povetacicept (ALPN-303) for IgA nephropathy and Acazicolcept (ALPN-101) for systemic lupus erythematosus (SLE)

Sources:

- Press releases

- OANDA

- Company Websites

- DealForma

Related Post: Top 20 Biopharma M&A of 2023 by Total Deal Value

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.